Brexit and the pandemic has paused many changes that the HRMC were planning to roll over the last year. This new rule will affect all VAT registered companies within the construction industry that report under the Construction Industry Scheme (CIS).

The Domestic Reverse Charge VAT legislation is a change in the way CIS registered construction businesses handle and pay VAT.

The new rules come into force on 1st March 2021, having previously been delayed from October 2020.

It is an anti-fraud measure designed to cut down on “missing trader” fraud. This is where companies receive high net amounts of VAT from their customers but have no intention of paying the VAT to HMRC. It will affect all VAT registered construction business who supply or receive construction and building services that are reported under the Construction Industry Scheme (CIS). It will mean that the customer (the contractor) will be responsible for the VAT due to HMRC rather than the supplier (the sub-contractor).

If you are a CIS sub contractor you will NO LONGER charge VAT to your CIS customers. Instead, on your invoices, you need to state your customer is responsible for the VAT and show what VAT rate should be applied.

If you are a CIS contractor, when you receive a bill from your CIS sub contractor you will be responsible for reporting both the input and output VAT on that bill.

However, there are some exemptions!

The reverse charge does not apply to:

- Supplies of VAT exempt building and construction services

- Supplies that are not covered by the CIS, unless linked to such a supply.

- Supplies of staff or workers

Also, the reverse charge does not apply to taxable supplies made to the following customers:

- A non-VAT registered customer

- End Users – this is a VAT registered customer who it not intending to make further on-going supplies of construction

- Intermediary suppliers who are connected eg a landlord and his tenant

- Overseas customers – this only applies to UK companies

What you need to do:

- Ensure that the software you are using is set up correctly. If you use KashFlow, an update is due to be pushed out in the next couple of weeks. If you use Xero, then this update has already been applied, and we can check the settings to make sure the VAT is accounting correctly. If you use Word, Excel or paper documents to raise your invoices, then you need to ensure that you adjust your template to have the correct narrative and that you do not charge VAT going forward.

If you would like to start using cloud-based software for raising invoices, then please email us at [email protected] and we can get you set up.

- Consider the effect on your cashflow. If you are a sub-contractor, you will no longer receive VAT with your invoices.

If you have been relying on the VAT month on month, then you will need to ensure that you have reserves to help with the short-term shortfall. If you are a contractor, you will likely have a short-term cash flow benefit as you will not have to pay your suppliers any VAT, but you must ensure your account for the VAT as both input and output tax along with the rest of your VAT movements.

- Make sure that you understand the process – whether you are a contractor or a sub-contractor. If you are a contractor, it could also be worth reaching out to your VAT registered sub-contractors to ensure that they understand the changes. You need to ensure that the invoices that YOU receive as a contractor do not have VAT on. If you receive any invoices that are incorrect, you will need to pass them back to be reissued correctly. This can cause delays in payment and could upset the subcontractors

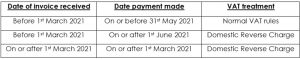

Treatment for existing contracts

If these rules apply to you the VAT treatment is determined based on the date of the contract and when it has been paid.

VAT schemes

Cash accounting CANNOT be used for CIS reverse charge – so you will have to account for these based on the invoice date.

However, if you supply services that are NOT subject to the reverse charge, for example to private individuals or end users, you must account for VAT on the dates you were paid.

These changes will apply from 1st March 2021 – so there isn’t much time to adjust your procedures.

If you have any questions about this, then please let us know, and we will be happy to work through your individual circumstances.